2 Best-In-Class REIT Buying Opportunities

ryasick

There always are bargains available in the stock market, including among real estate investment trusts (“REITs”). But opportunities to buy the highest quality, industry-leading, best-in-class REITs are few and far between. Right now is one of those times.

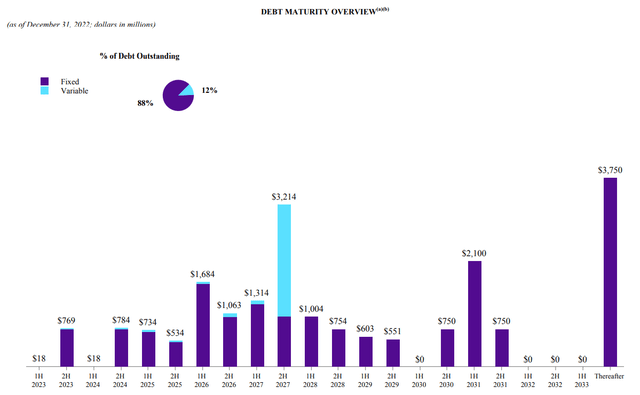

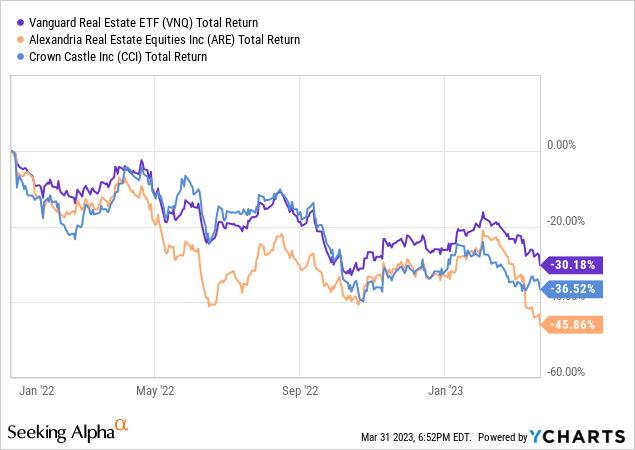

Over the last year, the broad-based Vanguard Real Estate ETF (VNQ) has dropped by about 32% in value on average largely because of investor fears that rising interest rates will negatively affect REITs’ operational performance and asset values.

Data by YCharts

Data by YCharts

On the contrary, REITs have a strong track record of outperforming through rising interest rate periods. There are multiple reasons for this, including the fact that REITs typically use lower levels of leverage than their private equity peers. Moreover, REITs typically lock in fixed-rate debt for long periods of time, which minimizes the headwind of higher rates in any given year.

And, of course, higher interest rates make it more expensive for corporations to own their own real estate, which in turn pushes up market rent rates.

Sometimes the market exhibits irrational exuberance, and sometimes it instead exhibits irrational fear.

Today, in the face of irrational fears driving down REIT stock prices, several of the highest-quality, fastest-growing, most creditworthy REITs have been pummeled.

Here are two examples along with the kind of real estate they own:

- Alexandria Real Estate Equities (ARE) – Class A life science buildings

- Crown Castle (CCI) – Wireless towers and small cells

Since the beginning of 2022, both REITs have underperformed the broader real estate index by a fairly wide margin, despite their investment-grade credit ratings and histories of above-average growth.

Data by YCharts

Data by YCharts

Does this mean that higher interest rates hurt ARE and CCI worse than the average REIT?

Not at all!

Recently, ARE issued bonds at coupon rates only a little higher than Treasury bond yields of equivalent term. Meanwhile, CCI has been deleveraging and reducing its floating rate debt exposure in order to tamp down on its already minor headwind of rising interest expenses.

Does ARE’s and CCI’s temporary price underperformance mean their growth stories are permanently impaired?

Not at all!

ARE and CCI both have very long growth runways ahead of them, and they’re each the best-positioned players in their respective industries to take advantage of secular growth tailwinds.

The average investor panics when they see falling stock prices and sells in order to alleviate the mental anguish. We take advantage of the market’s panic and buy when others are selling.

Below we highlight two best-in-class REITs that we are buying during this selloff.

Alexandria Real Estate Equities (ARE)

“Alexandria has achieved the three outputs that define a great company: superior results, distinctive impact, and lasting endurance.” -Jim Collins

ARE is an industry-leading landlord and developer in the life science real estate space.

These properties are irreplaceable, specialized Class A laboratory and office buildings located in the nation’s top research clusters in Boston, San Francisco, San Diego, New York City, Raleigh/Durham, and elsewhere.

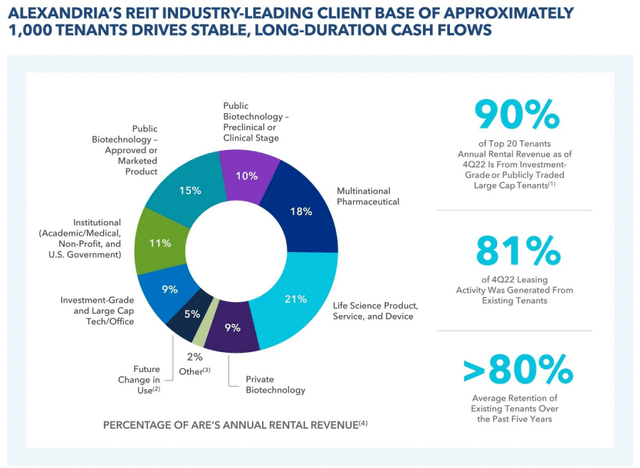

The management team, led by founder and executive chairman Joel Marcus, has deep and established relationships with the world’s leading pharmaceutical and biotech companies who make up its largely investment-grade tenant base.

ARE Q4 2022 Supplemental

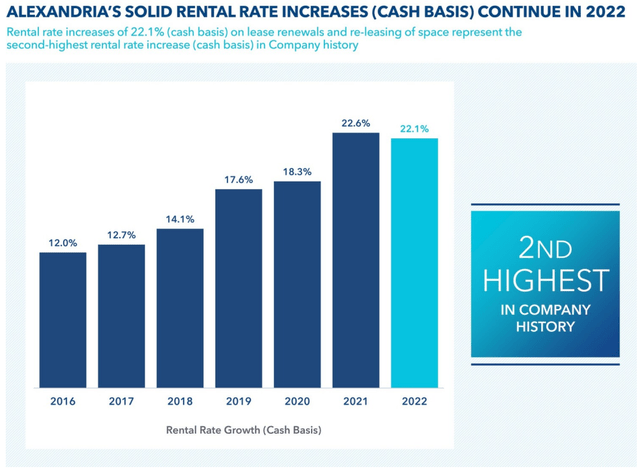

Given the superlative location and building quality of ARE’s portfolio, the REIT enjoys strong negotiating power when it comes to rent rates and lease terms. Its fully triple-net leased portfolio boasts a weighted average remaining lease term of 7.1 years, average annual rent escalators of about 3%, and releasing spreads consistently reaching into the double-digits.

In 2022, for example, ARE enjoyed its second-strongest year of leasing ever, with cash rent rate increases on new and renewal leases of 22%.

ARE Q4 2022 Supplemental

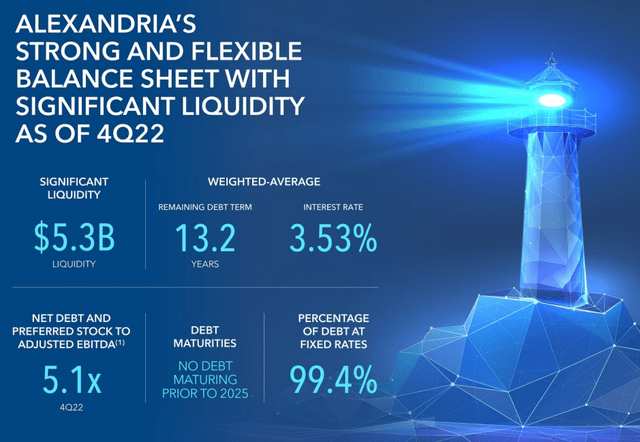

Of course, the REIT wouldn’t be best-in-class without a strong balance sheet to correspond to its high-quality portfolio of assets. And here ARE delivers with a BBB+ credit rating (top 10% for all public REITs), over £5 billion in liquidity, >99% of debt featuring fixed rates, a modest net leverage ratio of 5.1x, and a weighted average remaining debt term of 13.2 years.

ARE Q4 2022 Supplemental

In 2022, even as interest rates soared higher, ARE was able to issue £1.8 billion in bonds at an effective interest rate of 3.28% and an average term of 22 years.

In February 2023, ARE also issued some new bonds at very attractive interest rates.

The REIT priced £500 million of 12-year notes at an effective interest rate of 4.78% and another £500 million of 30-year notes at an effective interest rate of 5.18%.

That marks a relatively slight premium above Treasury yields of about 3.55% for 12-year T-bonds and 3.63% for 30-year T-bonds at the time. Clearly, the market recognizes ARE as an extremely creditworthy borrower!

The major advantage of being as creditworthy as ARE is that the REIT can issue unsecured debt at low enough rates to maintain an adequate investment spread even when interest rates are at their highest rate (outside of a recession) in 15 years.

ARE is perhaps the highest quality REIT on the public markets, and we’re happy to seize this opportunity to buy more shares of it.

As of this writing, ARE is priced at just 14x FFO and a 35% discount to its net asset value. Its dividend yield is also at around 4%, which is near its highest in a decade.

Crown Castle (CCI)

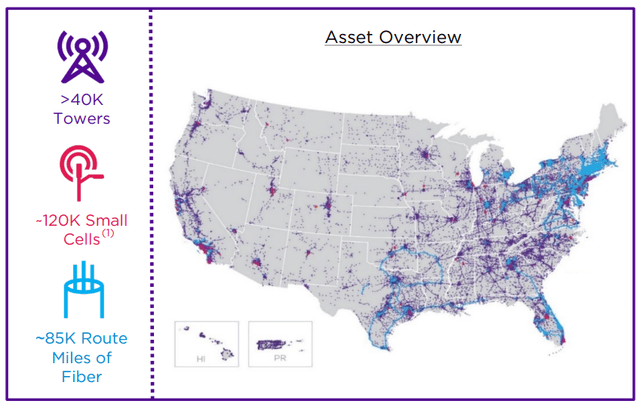

CCI owns an extensive portfolio of telecommunications infrastructure assets concentrated entirely in the United States, which is perhaps the strongest and most resilient wireless communications market in the world.

The portfolio consists of over 40,000 towers, about 120,000 small cell nodes, and ~85,000 route miles of fiber lines connecting it all.

CCI Q4 Earnings Presentation

Given the relatively low development of new towers, CCI’s primary source of portfolio growth comes from small cells.

These are mini-cell towers placed on telephone poles, billboards, rooftops, sports stadiums, or elsewhere in dense urban areas with high traffic. In 2023, management aims to roughly double its deployments of new small cells from around 5,000 in 2022 to 10,000 or more this year.

As for internal growth, however, the core towers segment carries most of the load. In 2022, the towers segment delivered 6.4% organic revenue growth, driven largely by the initial phase of the 5G rollout.

This year, management expects another 5% organic revenue growth.

As you would expect for a US-focused telecom infrastructure REIT, CCI’s top three tenants are the three major wireless carriers, together accounting for 75% of total revenue:

CCI Q4 2022 Supplemental

Not only are T-Mobile (TMUS), AT&T (T), and Verizon (VZ) all investment grade-rated, but they’re also all committed to investing heavily in expanding their infrastructure in order to remain competitive with each other.

CCI’s assets typically start out with only one tenant using the infrastructure, but more tenants can be added over time with little to no additional investment from the REIT. That allows CCI’s return on invested capital to rise steadily over time. In Q4 2022, the return on invested capital rose to 9.6% from Q4 2021’s 8.9%.

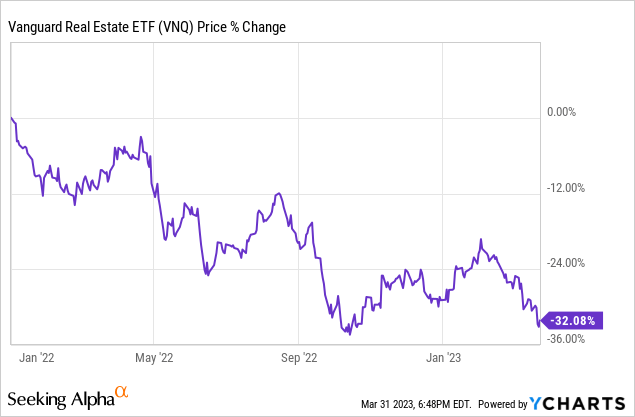

CCI’s strong balance sheet sports investment grade ratings of BBB/BBB+/Baa3 (S&P, Fitch, and Moody’s, respectively) along with a net debt to EBITDA multiple of 4.9x and an interest coverage ratio of around 18x.

One reason CCI has sold off recently is its ~12% of floating rate debt currently at an effective interest rate of about 5.5%.

While this will weigh on profits in 2023, it’s not a permanent headwind. What’s more, only about 3.5% of total debt matures in 2023, and not until the second half of the year at that.

CCI Q4 2022 Supplemental

After this, CCI won’t have any more debt maturities until the second half of 2024.

As of this writing, CCI trades at a remarkably low price to 2023 AFFO of 17.2x, and a 25% discount to NAV, which strikes us as a steal for this best-in-class wireless infrastructure REIT.

Though CCI has a few relatively minor headwinds today, we remain bullish on the long-term growth prospects of this asset class because of the major growth yet to come in 5G, the Internet of Things, autonomous vehicles, and various other mobile data usage.

The management is confident that they will return to 7%-8% annual dividend growth in a few years from now, and today, the shares are offered at a near 5% dividend yield, the highest yield in many years.

Bottom Line

When best-in-class companies go on sale, it’s a good idea to pounce on them when you have the chance. These blue-chip names tend not to remain cheaply valued for long.

That’s our view when it comes to ARE and CCI.

These are two high-quality, well-managed REITs with strong balance sheets and long growth runways ahead of them.

We think higher interest rates will not have a material impact on either of these REITs’ operational performance, and yet the market has discounted them severely.

As such, we view the opportunity for both REITs today as being akin to buying a Porsche for the price of a Hyundai – a luxury sports car for the price of a modest sedan.

While we cannot predict how long these discounts will last, we are happy to take advantage of them for as long as they do!