12 Dividend Blue-Chip Bargains That Will Leave You Swimming In …

Deagreez

The Original Special Video Report Version Of This Article Was Published On Dividend Kings (Preparing For Recession Part 12) On June 2nd, 2022. The data has been updated for March 22nd. It is part of the Dividend Kings 75 Part Preparing For Recession Video Series.

This week I’m attending a work conference and thus publishing updated versions of these video articles.

————————————————————————————-One of my most important goals is to help you prepare emotionally and financially for the market’s inevitable downturns.

This includes helping you remain calm, rational, and disciplined throughout all market and economic cycles.

Which is when we have an economic update every six weeks.

- Recession Watch Video: Can The Fed Pull Off A Soft Landing?

- Next Recession/Banking Crisis Watch video coming Monday, April 3rd.

To paraphrase Napoleon, the definition of a stock market genius is

The investor who can do the average thing when everyone else around him/her is losing their mind.”

Why?

After Market Hell, Market Heaven Follows…If You Can Ride Out The Short-Term Pain.

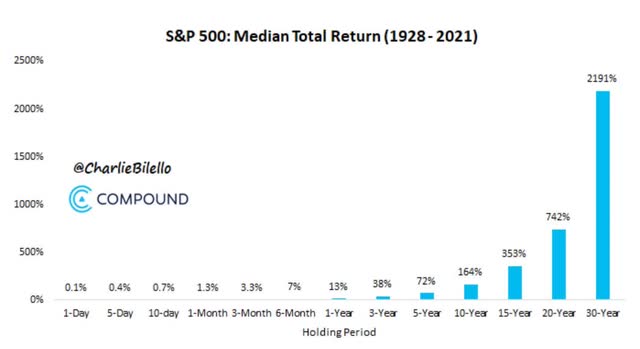

Charlie Bilello

From the first time the market hits -25%, the average 12-month gain is +22%, and ten years later, the average gain is 214%, with stocks more than tripling.

Even during the 1970s stagflation, stocks delivered solid 2X to 3X gains after 25% bear markets.

Historically, new bull markets start with a 48% rally 12 months after the final bottom (which you can never know when they have finally happened).

Charlie Bilello

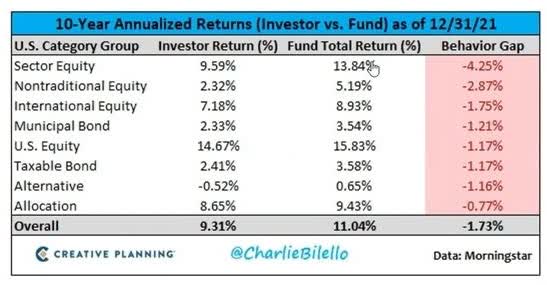

This is why you need to avoid the temptation of market timing.

Charlie Bilello

Most investors can’t, and that’s why investors of every kind historically underperform mutual funds and ETFs by 1.73% per year.

- 67% less inflation-adjusted wealth over 30 years

- perfect market time since 1970 would have delivered 22% better returns over 40 years

- compared to a 6500% return for stocks

- for every £1 in extra profit you could make with perfect market timing, you risk not making a likely £295.

Charlie Bilello

And even perfect economic timing isn’t enough to beat buy-and-hold blue-chip investing over the long term.

But of course, even 12 months in a bear market can feel like an eternity.

Thus the reason for the Dividend Kings 75-part series on how to emotionally and financially prepare for recessions and bear markets.

- Part 51: How To Hedge Your Portfolio Against Stagflation

- Part 52: Preparing For The Potential Debt Ceiling Crisis

- Part 53: How Bad This Bear Market Is Likely To Get

- Part 54: Don’t Fall Victim To Recession Doomsday Prophets

- Part 55: The Right And Wrong Way To Think About Forecasts

- Part 56: Ignore The Noise And Keep Buying

- Part 57: How To Hedge Against Recession

- Part 58: When Experts Fail

- Part 59: How To Rebalance A Value Portfolio

- Part 60: DK £1 Million Retirement Portfolio Rebalancing

- Part 61: DK High-Yield Blue-Chip Portfolio Rebalancing

- Part 62: DK Deep Value Blue-Chip Portfolio Rebalancing

- Part 63: DK Fortress Portfolio Rebalancing

- Part 64: DK Phoenix Portfolio Rebalancing

- Part 65: DK Zen Retirement Portfolio Rebalancing

- Part 66: DK Zen Yield Portfolio Rebalancing

- Part 66: DK Zen Value Portfolio Rebalancing

- Part 67: DK Zen Quality Portfolio Rebalancing

- Part 68: DK Zen Growth Portfolio Rebalancing

- Part 69: The Power Of “Strategic Mediocrity.”

- Part 70: Using The Right Benchmark Is Important

- Part 71: Useful Tools For Portfolio Planning, Management, and Recession Monitoring

- Part 72: Why Smart Investors Should Look Forward To Bear Markets

- Part 73: Build Your Financial Future On Facts, Not Fantasies

- Part 74: Ways Of Emotionally Dealing With This Bear Market

- Part 75: The Zen Of Bear Market Investing During Recessions

Let me share why diversification can turbocharge your long-term income growth and leave you swimming in cash in retirement.

Why Diversification Is Important In High-Yield Portfolios

Last week we saw why diversification is the only “free lunch” on Wall Street and how it reduces both fundamental risk and volatility.

Today we’ll see why it also is the key to maximizing long-term retirement income.

Let’s start with the most extreme example, the single highest-yielding blue chip on Wall Street.

If you put all your savings into MPLX, you’d get a safe 9.2% yield that analysts expect to grow at 3% over time.

- slightly ahead of the bond market’s 30-year inflation expectations of 2.3%.

Of course, owning a single stock exposes you to concentrated fundamental risk.

- BBB credit rating = 7.5% risk of bankruptcy over 30 years

- 1 in 13.3 chance of going to zero.

But here’s how to harness the principles of safe high-yield, combined with diversification.

- MPLX (MPLX)

- Magellan Midstream (MMP)

- Legal & General (OTCPK:LGGNY)

- Altria (MO)

- Enterprise Products Partners (EPD)

- British American Tobacco (BTI).

Instead of a single 9.2% yielding MPLX, we now have six blue chips yielding 7.4% in three sectors and from two countries on two continents.

- quality is nearly as high as dividend aristocrats

- from a portfolio that yields 3X as much as the dividend aristocrats.

Over the long-term, analysts expect 5.2% growth to drive 12.6% long-term returns.

| Investment Strategy | Yield | LT Consensus Growth | LT Consensus Total Return Potential | Long-Term Risk-Adjusted Expected Return |

| 6 High-Yield Blue-Chips | 7.4% | 5.20% | 12.6% | 8.8% |

| Safe Midstream | 5.6% | 6.0% | 11.6% | 8.1% |

| High-Yield | 3.1% | 12.7% | 15.8% | 11.1% |

| REITs | 2.8% | 6.5% | 9.3% | 6.5% |

| Dividend Aristocrats | 2.2% | 8.9% | 11.1% | 7.8% |

| S&P 500 | 1.7% | 8.5% | 10.2% | 7.1% |

Click to enlarge

(Sources: Morningstar, FactSet, Ycharts.)

Market and aristocrat beating return potential and 3X to 5X better safe yield?

Yes, please, I’ll have some of that.

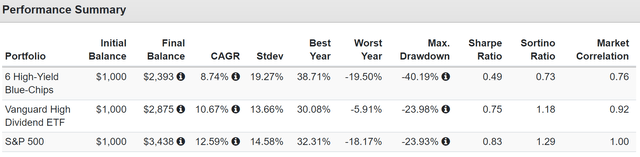

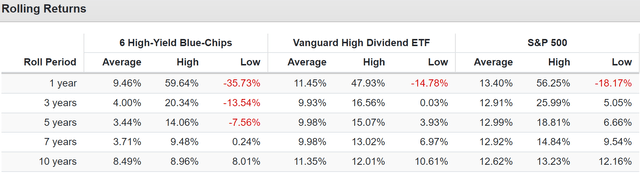

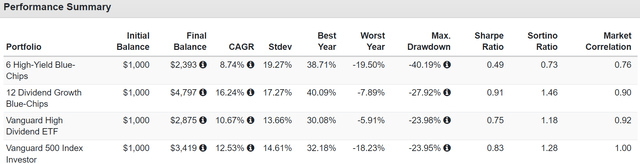

High-Yield Blue-Chip Total Returns Since November 2012 (Annual Rebalancing)

Portfolio Visualizer Premium

Portfolio Visualizer Premium

Portfolio Visualizer Premium

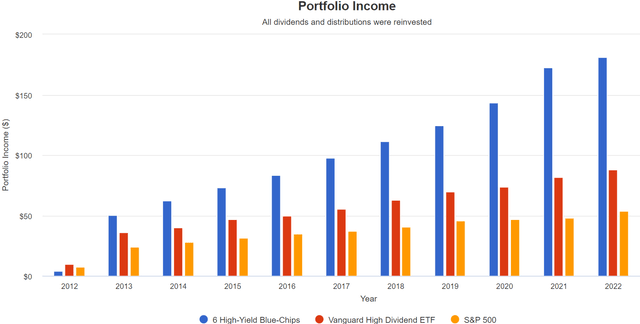

| Portfolio | 2013 Income Per £1,000 Investment | 2022 Income Per £1,000 Investment | Annual Income Growth | Starting Yield | 2021 Yield On Cost |

| S&P 500 | £24 | £54 | 9.4% | 2.4% | 5.4% |

| Vanguard High Yield ETF | £36 | £88 | 10.4% | 3.6% | 8.8% |

| 6 High-Yield Blue-Chips | £50 | £181 | 15.4% | 5.0% | 18.1% |

Click to enlarge

(Source: Portfolio Visualizer Premium.)

And now, we can add dividend growth stocks to showcase the true power of diversification.

Why Dividend Growth Stocks Are An Important Part Of A Diversified Portfolio

Here are six hyper-growth dividend blue-chips, which yield just 1.4% (vs. Nasdaq’s 1%), but offer 21.3% long-term return potential.

- Lowe’s (LOW)

- ASML Holding (ASML)

- Qualcomm (QCOM)

- Taiwan Semi (TSM)

- Mastercard (MA)

- Visa (V).

- and are far higher quality than the dividend aristocrats

- 1.64% average 30-year bankruptcy risk = A- positive outlook average credit rating vs. A- stable for aristocrats

- half the bankruptcy risk of the aristocrats.

What if we combine these six hyper-growth dividend growth Ultra SWANs with our six high-yield blue-chips?

Now we have a 4.4% yielding portfolio with a 12.6% long-term growth consensus for a 16.9% long-term total return potential.

| Investment Strategy | Yield | LT Consensus Growth | LT Consensus Total Return Potential | Long-Term Risk-Adjusted Expected Return | Long-Term Inflation And Risk-Adjusted Expected Returns |

| Safe Midstream | 5.6% | 6.0% | 11.6% | 8.1% | 5.6% |

| 12 Dividend Growth Blue-Chip Portfolio | 4.4% | 12.55% | 16.9% | 11.8% | 9.3% |

| High-Yield | 3.1% | 12.7% | 15.8% | 11.1% | 8.5% |

| 10-Year US Treasury | 2.9% | 0.0% | 2.9% | 2.9% | 0.4% |

| REITs | 2.8% | 6.5% | 9.3% | 6.5% | 4.0% |

| Dividend Aristocrats | 2.2% | 8.9% | 11.1% | 7.8% | 5.2% |

| S&P 500 | 1.7% | 8.5% | 10.2% | 7.1% | 4.6% |

Click to enlarge

(Sources: Morningstar, FactSet, Ycharts.)

That’s potentially better returns than the Nasdaq and VYM over time, and with a much higher yield to start with.

Inflation-Adjusted Consensus Return Potential: £1,000 Starting Investment

| Time Frame (Years) | 7.7% CAGR Inflation-Adjusted S&P Consensus | 8.7% Inflation-Adjusted Dividend Aristocrats Consensus | 14.4% CAGR Inflation-Adjusted 12 Dividend Growth Blue-Chip Portfolio Consensus | Difference Between Inflation Adjusted 12 Dividend Growth Blue-Chip Portfolio Consensus Vs S&P Consensus |

| 5 | £1,445.67 | £1,514.08 | £1,955.15 | £441.07 |

| 10 | £2,089.97 | £2,292.44 | £3,822.62 | £1,530.19 |

| 15 | £3,021.42 | £3,470.93 | £7,473.82 | £4,002.89 |

| 20 | £4,367.98 | £5,255.26 | £14,612.46 | £9,357.20 |

| 25 | £6,314.67 | £7,956.89 | £28,569.60 | £20,612.72 |

| 30 | £9,128.95 | £12,047.36 | £55,857.96 | £43,810.60 |

Click to enlarge

(Sources: DK Research Terminal, FactSet.)

Even if the growth stocks in our portfolio only grow as expected for 10 years, that’s potentially 4X inflation-adjusted returns in the next decade.

| Time Frame (Years) | Ratio Aristocrats/S&P | Ratio Inflation-Adjusted 12 Dividend Growth Blue-Chip Portfolio Consensus Vs S&P Consensus |

| 5 | 1.05 | 1.35 |

| 10 | 1.10 | 1.83 |

| 15 | 1.15 | 2.47 |

| 20 | 1.20 | 3.35 |

| 25 | 1.26 | 4.52 |

| 30 | 1.32 | 6.12 |

Click to enlarge

(Sources: DK Research Terminal, FactSet.)

Or, to put it another way, about 2X the market’s return potential with 3X the much safer yield.

12 Dividend Growth Blue-Chip Total Returns Since November 2012 (Annual Rebalancing)

(Source: Portfolio Visualizer Premium)

Analysts expect about 16% long-term returns, which these 12 blue chips delivered over the last decade.

- including two bear markets

- the most severe recession in 75+ years

- and half of these companies being in severe bear markets.

From disappointing returns to outstanding market-smashing ones, and with lower volatility to boot!

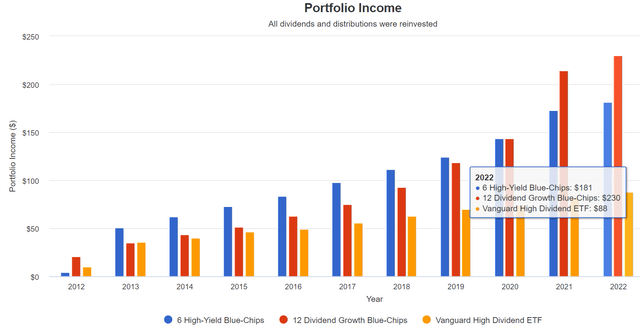

And take a look at the income growth!

(Source: Portfolio Visualizer Premium)

(Source: Portfolio Visualizer Premium.)

| Portfolio | 2013 Income Per £1,000 Investment | 2022 Income Per £1,000 Investment | Annual Income Growth | Starting Yield | 2022 Yield On Cost |

| 6 High-Yield Blue-Chips | £50 | £181 | 15.4% | 5.0% | 18.1% |

| Vanguard High Yield ETF | £36 | £88 | 10.4% | 3.6% | 8.8% |

| 12 Dividend Growth Blue-Chips | £36 | £230 | 22.8% | 3.6% | 23.0% |

Click to enlarge

(Source: Portfolio Visualizer Premium.)

In 2013, this portfolio yielded 3.6%, but it delivered 23% annual dividend growth over the last decade.

- precisely because dividend reinvestment and annual rebalancing benefited from the high-yield blue-chip bear markets.

What income growth do analysts expect in the future?

| Analyst Consensus Income Growth Forecast | Risk-Adjusted Expected Income Growth | Risk And Tax-Adjusted Expected Income Growth |

Risk, Inflation, And Tax Adjusted Income Growth Consensus |

| 22.2% | 17.1% | 14.5% | 12.0% |

Click to enlarge

(Source: DK Research Terminal, FactSet.)

Very similar income growth. Adjust for the risk of these companies now growing as expected, inflation, and taxes, and you get 12% real expected income growth.

Now compare that to what they expect from the S&P 500 (SP500).

| Time Frame | S&P Inflation-Adjusted Dividend Growth | S&P Inflation-Adjusted Earnings Growth |

| 1871-2021 | 1.6% | 2.1% |

| 1945-2021 | 2.4% | 3.5% |

| 1981-2021 (Modern Falling Rate Era) | 2.8% | 3.8% |

| 2008-2021 (Modern Low Rate Era) | 3.5% | 6.2% |

| FactSet Future Consensus | 2.0% | 5.2% |

Click to enlarge

(Sources: S&P, FactSet, Multipl.com.)

What about a 60/40 retirement portfolio?

- 0.5% consensus inflation, risk, and tax-adjusted income growth.

In other words, these 12 dividend growth blue-chips offer:

- 3X more than the market’s yield (and a much safer yield at that)

- 4X its long-term inflation-adjusted consensus income growth potential

- 24X better long-term inflation-adjusted income growth than a 60/40 retirement portfolio.

This is the power of dividend growth blue-chip investing that combined both yield and growth.

Bottom Line: Diversified Growth And Value Is The Key To Maximum Retirement Income

High-yield blue-chips are great for maximum safe income today. Still, if you want to maximize your income over time, you must also be diversified into fast-dividend growers and even future dividend blue chips (like Autodesk and Amazon).

How does a very safe 4.4% yield today sound?

How about 17% long-term returns?

Or what about 22% annual income growth for years to come?

That’s what MPLX, MMP, LGGNY, MO, EPD, BTI, LOW, ASML, QCOM, TSM, MA, and V are offering today.

Better yet, you can turn these companies into a diversified and prudently-risk managed balanced portfolio can be constructed to deliver:

- far superior yield today

- market-beating long-term returns

- 33% lower volatility

- 50% lower peak declines than a 60/40 in even the most extreme market crashes

- 50% to 60% lower peak bear market declines than the S&P 500

- far superior long-term retirement income than a 60/40.

This weekend I’ll show you exactly how to combine the power of high-yield blue-chips, with hyper-growth blue-chips, and create the ultimate high-yield income growth sleep night portfolio.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange.

Please be aware of the risks associated with these stocks.