2 Preferred Stocks 'Disappear,' 4 Offered

happyphoton/iStock via Getty Images

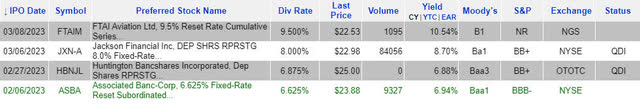

New offerings summary:

CDX3Investor.com

The ghosts of SIVB and SBNY preferred stocks

The failures of two large regional banks were felt by the preferred stock niche, and in an extreme way we don’t normally get to see: instead of losing all of their value “slowly” the two preferreds issued by these banks went “bust” suddenly, corresponding with the bank runs and then sudden collapse / FDIC take-over of their issuers.

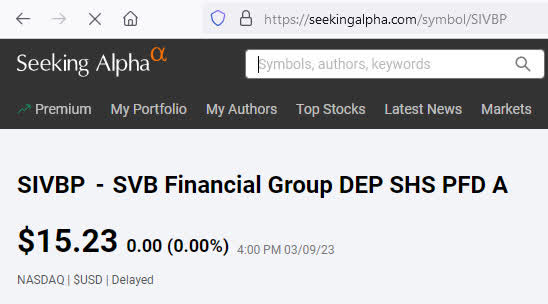

Silicon Valley Bank’s 5.25% series A non-cumulative preferred and Signature Bank’s 5% series A non-cumulative preferred both remained in quote lookups like ghosts between the time trading was halted (when the two banks failed), and when post-failure trading began on the OTC; e.g. here at Seeking Alpha’s SIVBP and SBNYP pages we saw their final Nasdaq / NYSE trading prices documented as screen-captured below:

SeekingAlpha.com

For SIVBP the last closing price a holder of the preferred saw within their portfolio – before bank failure and the security later moving to the OTC as SIVBQ – was £15.23.

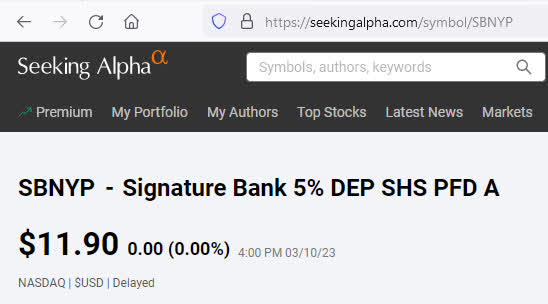

And similarly, for SBNYP:

SeekingAlpha.com

Here the last closing price a holder of the preferred saw within their portfolio – before later moving to the OTC as SBNYL – was £11.90. Of course the common shareholders experienced a similar phenomenon: the SBNY page showed a last price of £70 per common share for Signature Bank (OTC:SBNY), while the SIVB page showed a last price of £106.04 per common share for SIVB Financial Group (SIVB), before OTC trading later took place.

But as announced by the FDIC when New York Community Bancorp (NYCB) assumed the Signature deposits, “The FDIC estimates the cost of the failure of Signature Bank to its Deposit Insurance Fund to be approximately £2.5 billion. The exact cost will be determined when the FDIC terminates the receivership.” If the FDIC is going to take a £2.5 billion loss then that obviously means it would take a near-miracle for anything to be left over for the former preferred or common stockholders of SBNY.

And similarly, the resolution for SIVB was announced this week, with First Citizens BancShares, Inc. (FCNCA) taking over the deposits and certain assets of SIVB.

The FDIC’s loss estimate suggests that here too it would take a near-miracle for anything to be left over for the preferred or common shareholders of SIVB: “The FDIC estimates the cost of the failure of Silicon Valley Bank to its Deposit Insurance Fund (DIF) to be approximately £20 billion. The exact cost will be determined when the FDIC terminates the receivership.”

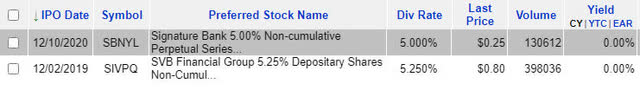

As of trading on 3/28/2023, OTC symbols SBNYL and SIVPQ have been assigned to the two preferreds, and they are trading at “near total loss” levels with perhaps the remaining slight positive value representing pure speculation that the FDIC receivership losses might turn out differently than presently estimated:

CDX3Investor.com

Source: CDx3 Notification Service subscriber website, 3/28/2023

Similarly, as of the time of this writing the common shares of Signature and SVB are trading at 17 cents and 31 cents respectively on the OTC, a “near total loss” for anyone who had previously owned them.

According to ETF Channel, the holdings of SPY (the SPDR S&P 500 ETF) had included both SBNY and SIVB leading up to their failures; accordingly so did the RSP ETF (the equal weight version). Interestingly, the index provider announced that both companies were being “swapped out” of the index — in favor of Bunge (BG) to replace Signature, and Insulet (PODD) to replace SVB.

What a luxury these index providers have, where they can replace a “near total loss” in the portfolio with a new position, with the stroke of a pen!

“Actual” owners of the stocks were not so lucky: suppose you were independently following the S&P 500 index components with an equal-weight strategy by owning each of the individual components yourself. How exactly were you supposed to “sell SBNY to buy BG” or “sell SIVB to buy PODD” when the value of your SBNY and SIVB positions had both “gone to nearly zero” by the time the index changes were announced?

And in a similar fashion, any preferred stock owners who still held SIVBP and/or SBNYP in their portfolios leading up to the bank failures, didn’t have the option to “sell out of” those positions and recycle the proceeds into a new holding; instead, those positions got nearly wiped out, leaving next to no proceeds to reinvest.

Hence, any “replacement” holdings would have needed to be funded by selling down other positions in the portfolio or with entirely new funds.

Given this dynamic – and especially when considering that many holders of preferred stocks, ETDs, and other income-producing stocks use portfolio-level leverage – it is easy to envision how these two prominent bank failures would in turn have caused subsequent selling pressure within the universe of preferred stocks broadly, even without any ensuing panic selling (which was particularly evident in the preferred shares of other regional banks, like First Republic (FRC) in the trading sessions that followed the failures of SIVB and SBNY).

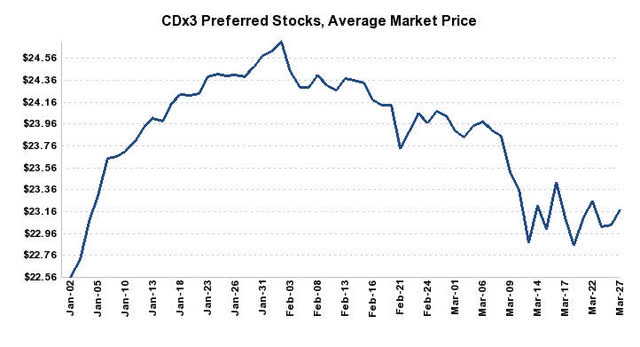

Neither SIVBP nor SBNYP had been “CDx3 Complaint” preferred stocks (neither had scored a 10 out of 10 on our rating system), because like most bank preferreds both had been non-cumulative. But of course that did not prevent the universe of CDx3 Compliant preferreds/ETDs from losing market value during the month of March amidst the contagion, with average CDx3-compliant market price falling to £23.18 as of the time of this writing, representing an approximate 7.3% discount to par and a current yield of about 6.3%.

The year-to-date gains that had previously stood as of the end of February have since been nearly wiped out, with the market price of the group on a year-to-date basis shown below:

CDX3Investor.com

About the new issues

Before the bank failures hit, we saw four new preferred stock and ETD offerings hit the market since our last update.

First, Huntington Bancshares (HBAN) offered £325 million worth of new series J non-cumulative “fixed-rate reset” preferred stock, offering an initial dividend rate of 6.875% against par value, until April of 2028.

At that point the rate resets to the then-current five-year treasury rate plus a spread of 2.704%. At issuance the new shares were rated Baa3 (stable) by Moody’s, BB+ (stable) by S&P, and BB+ (stable) by Fitch. Trading took place initially under temporary symbol HBNJV on the OTC before trading eventually moves to permanent symbol HBANJ on the Nasdaq.

Jackson Financial (JXN) offered £550 million of new series A non-cumulative “fixed-rate reset” preferred stock, with ratings at issuance of Ba1, BB+, and BB+ from Moody’s, S&P, and Fitch respectively.

The new shares offer an initial dividend rate of 8% until March of 2028, after which the rate will reset to the then-current five-year treasury rate plus a spread of 3.728%. Initial trading on the OTC took place under symbol JXNFV, with permanent symbol to be JXN-A (JXN.PA) on the New York Stock Exchange.

FTAI Aviation (FTAI) offered £65 million of new series D cumulative “fixed-rate reset” preferred stock, offering an initial dividend rate of 9.5% until June of 2028. The rate will then reset to the then-current five-year treasury rate plus a spread of 5.162%.

The new shares were rated B1 by Moody’s and B by Fitch. Initial trading took place on the OTC under symbol FAVTV before moving to permanent symbol FTAIM on the Nasdaq.

And finally Associated Banc-Corp (ASB) offered £300 million of new 6.625% “fixed-rate reset” subordinated exchange traded notes due 2033. At issuance the new notes were rated BBB- by S&P with a stable outlook, and Baa1 by Moody’s but with a note that the rating was under review for downgrade.

The initial 6.625% rate is set to reset in March of 2028, to the then-current five-year treasury rate plus a spread of 2.812%. The new notes now trade on the New York Stock Exchange under symbol ASBA.

SEC filings for further information: HBANJ, JXN-A, FTAIM, ASBA

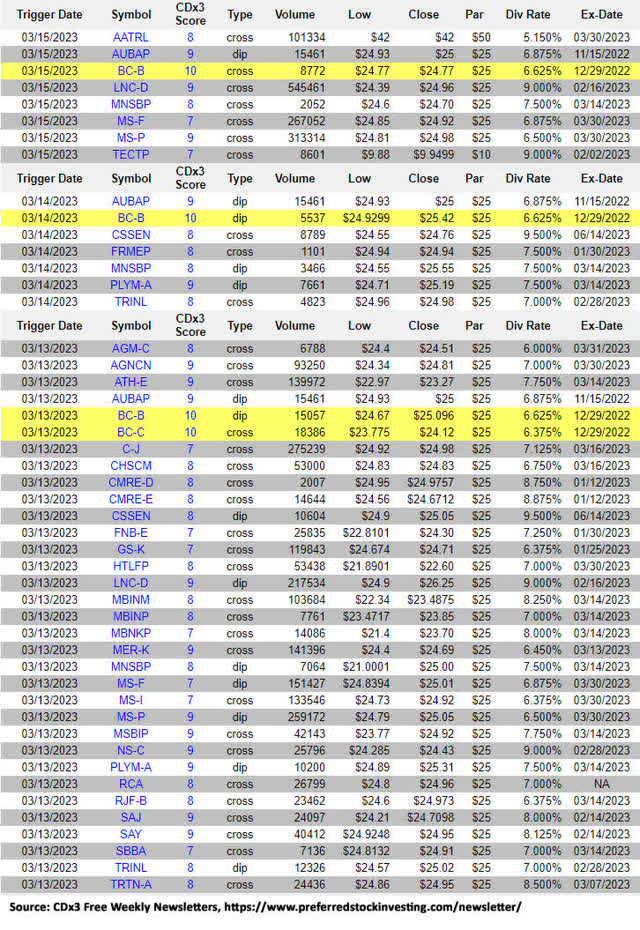

Past preferred stock IPOs below par

In addition to covering new preferred stock and ETD offerings, here at CDx3 Notification Service we also track past offerings, with alerts when securities fall below their par values. Here are some of the recent dips/crosses below par we observed:

CDX3Investor.com

Note: Any yellow highlighted entries indicate eligibility for the “CDx3 Bargain Table.”

Until Next Time…

Here at CDx3, our typical articles will provide month-end preferred stock (and ETD) IPO summaries, plus a look at selected past preferred stock IPOs that are now trading below par.

Whether you are the kind of investor who sticks with preferred stocks with a CDx3 Compliance Score rated 10 out of 10, or whether your portfolio has room for 9-score-and-lower securities, stay tuned for future articles recapping new IPOs and interesting preferred stock activity that we notice here at the CDx3 Notification Service.

Thanks for reading!

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange.

Please be aware of the risks associated with these stocks.