3 Strong Buy Stocks You May Have Missed

The Fed is between a rock and a hard place. They really do need to continue telling the market that they’re taking care of the banking crisis. And that isn’t easy to do when you have reports coming out everyday about how people are jittery about keeping their cash in smaller banks and are therefore pulling out.

A number of other banks are reportedly not doing as well as we would like. The rescue plan seems to be to keep the money flowing through the banks. The strategy appears to be working so far.

But will it be just as effective if more and more banks throw in the towel? Who knows? On the other hand, the Fed needs to keep raising rates.

If it does nothing, there could be negative sentiment because that is the only plan to alleviate inflation that has been hurting people and companies alike. But if it does raise rates, it can make a bad situation worse. We don’t know what will be announced today, but my guess is it will be another small increase in rates.

Just enough to convince people that the inflation fight is on track. And really, if banks face a cash crunch that itself will limit credit availability, as some experts have been saying. Since this is something that the Fed has been trying to achieve anyway, this wouldn’t be so bad after all.

Whatever the Fed decides, it is unlikely to provide much of a future plan because things have gotten far more uncertain than they were say a couple of weeks ago. Under the circumstances, an investor’s best bet remains the stock market, particularly, the stocks of companies that are likely to hold up better than others in the next year or so, given the macro concerns. We have three of these lined up below that you may want to check out:

Comfort Systems USA, Inc. FIX Houston, Texas-based Comfort Systems provides mechanical and electrical installation, renovation, maintenance, repair and replacement services for building owners and developers, general contractors, architects, consulting engineers, and property managers in the commercial, industrial, and institutional markets in the U.S. It is primarily engaged with mechanical, electrical, and plumbing (MEP) systems; heating, ventilation, and air conditioning (HVAC) systems, as well as plumbing, piping and controls, off-site construction, electrical, monitoring, and fire protection.

Both the mechanical and electrical businesses are seeing very strong demand, which is allowing the company to raise prices of materials and labor supplied. It is also receiving advance payments with respect to the offsite modular construction business. This business accounts for its enviable backlog and provides improved visibility.

Additionally, the addition of South Carolina’s Eldeco will be neutral to slightly accretive to its earnings this year. Therefore, management is optimistic that 2023 will be a year of continued growth and strong profitability. Management sentiments are reflected in the Zacks #1 (Strong Buy) rating, the 7.8% revenue growth and 20.0% earnings growth expectations for the year, with further growth of a respective 2.0% and 11.3% in 2024.

What’s more, analysts have raised their estimates by 33 cents (5.5%) for 2023 and by £1.00 (16.5%) for 2024. Comfort Systems beat analyst estimates in each of the last four quarters at an average rate of 9.9%. While on a P/E basis the shares are not exactly cheap when compared to the S&P 500, the point is that neither are they expensive, considering that they trade at a 16% discount to the related industry.

Therefore, given the current market conditions and the likelihood of continued slowdown, this is one of the relatively safer stocks out there. Bloomin’ Brands, Inc. BLMN Tampa, Florida-based Bloomin’ Brands has owned-and-operated and franchised casual, upscale casual and fine dining restaurants in the United States and internationally.

Its four restaurant concepts are Outback Steakhouse, a casual steakhouse restaurant; Carrabba’s Italian Grill, a casual Italian restaurant; Bonefish Grill; and Fleming’s Prime Steakhouse & Wine Bar, a contemporary steakhouse. Last year, the company benefited from stronger pricing, which increased the average check per person, improved profitability and offset the still-weak traffic. Despite continued commodity and labor cost inflation, management expects to grow its earnings 15-19% this year.

Results will be helped by an extra week that will add 14 cents to the bottom line this year and also by a Brazilian tax regulation that will add another 25 cents. Comps will be up 2-4%. While there were 39 net additions to the restaurant base in 2022, this year we’ll see total additions of 30 to 35.

The lower count is probably a conservative number given ongoing macro concerns and the impact on credit availability. The Zacks Rank #1 stock with a Value Score of A and Growth Score of B is expected to see revenue growth of 6.8% and earnings growth of 15.1% this year. This will be followed by 2.1% revenue growth and 4.4% earnings growth the following year.

In the last 30 days, analysts raised their 2023 estimates by an average 7 cents (2.5%) and 2024 estimate by 5 cents (1.7%). The preceding four-quarter average positive surprise posted by Bloomin’ Brands was 7.5%. The shares are trading relatively close to their median value over the past year but at a nearly 50% discount to the S&P 500 and a 64% discount to the industry.

Therefore, they are certainly cheap and worth buying at these levels. The Interpublic Group of Companies, Inc. IPG New York-based Interpublic Group provides advertising and marketing technologies and services and data management capabilities through the Media, Data & Engagement Solutions; Integrated Advertising & Creativity Led Solutions; and Specialized Communications & Experiential Solutions segments.

It operates globally. In 2022, the company grew in every world region and across client sectors with particular strength in consultative media services, healthcare marketing, experiential marketing and commerce on the strength of its best-in-class data capabilities and creative assets. Management expects that the company’s expertise in emerging media, precision and accountability will generate continued growth in these segments, despite the macro uncertainty, as the company continues to be steered toward higher value solutions.

2023 projections look very conservative at 2-4% organic net revenue growth (organic growth was 14% in the last three years). The EBITA margin is however expected to expand to 16.7% for the year. Analysts are in agreement about Interpublic’s growth prospects.

They estimate that revenue will grow 8.4% and earnings 2.2% this year, followed by revenue growth of 3.7% and earnings growth of 8.3% in 2024. Estimates for the two years are up 3 cents and a penny respectively, in the last 30 days. The average positive surprise in the last four quarters was 8.2%.

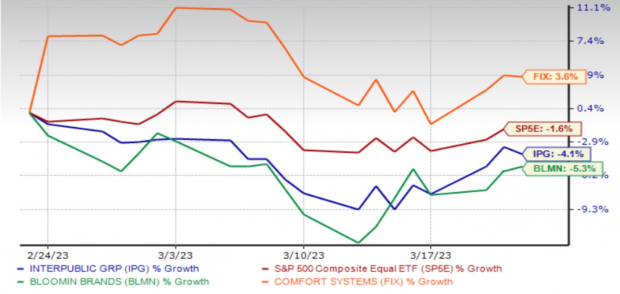

Shares of this Zacks Rank #1 stock trade relatively close to their median value but at a premium to the industry. Still, considering its growth trajectory and customer base, they are worth your money. One-Month Price Performance

Image Source: Zacks Investment Research 5 Stocks Set to Double Each was handpicked by a Zacks expert as the #1 favorite stock to gain +100% or more in 2021.

Previous recommendations have soared +143.0%, +175.9%, +498.3% and +673.0%. Most of the stocks in this report are flying under Wall Street radar, which provides a great opportunity to get in on the ground floor.

Today, See These 5 Potential Home Runs >>

Click to get this free report Interpublic Group of Companies, Inc. (The) (IPG) : Free Stock Analysis Report Bloomin’ Brands, Inc. (BLMN) : Free Stock Analysis Report

Comfort Systems USA, Inc. (FIX) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.