Brookfield Renewable: Exciting Growth Prospects At A Bargain …

CalypsoArt/iStock via Getty Images

For people who like drama, there is no shortage of it in the market these days, especially with regional banks like First Republic (FRC) see-sawing back and forth every day. There is no doubt that regional banks and perhaps even the banking giants like Bank of America (BAC) and JPMorgan Chase (JPM) are battleground stocks today.

For those who don’t want drama, perhaps it’s a better idea to buy and hold onto dividend stocks that are far-removed from the banking industry, and that are trading in value territory with strong growth prospects.

Such I find the case to be with Brookfield Renewable Corporation (NYSE:BEPC) which unlike Brookfield Renewable Partners (BEP), does not come with the complexity of a Schedule K-1 come tax time. Let’s explore why BEPC offers a good mix of income and capital appreciation potential and current levels.

Why BEPC?

Brookfield Renewable Corporation is a Canadian company that owns and operates a diverse portfolio of renewable energy assets across the world, including hydroelectric, wind, solar, and energy storage facilities.

In recent years, BEPC has significantly expanded its renewable energy portfolio through a combination of organic growth and strategic acquisitions.

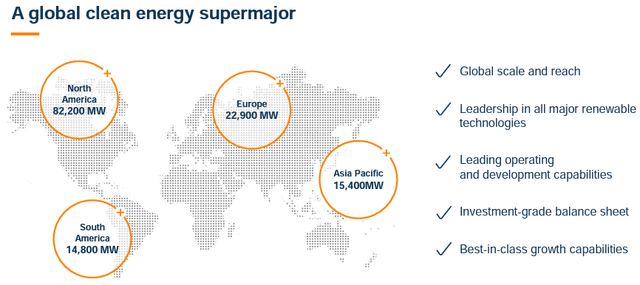

The company has a presence in North America, South America, Europe, and Asia.

At present, BEPC has £77 billion in global renewable assets under management. As shown below, BEPC’s assets generate a combined 135,300 MW of renewable energy worldwide.

Investor Presentation

Meanwhile, BEPC has delivered on management’s long-term growth objectives, with accretive FFO per share growth of 8% to £1.56 in 2022. This came from a combination of both organic growth and new strategic projects coming online.

Importantly, BEPC has 19,000 MW of capacity that’s currently under development and / or in advanced stages. This is equivalent to a substantial 14% of BEPC’s current capacity.

Decarbonization by governments around the world is expected to create unparalleled commercial opportunity, with management expecting over £150 trillion in investment capital by all players over the next 3 decades. As such, this undertaking would have to also include nuclear and renewable natural gas, among other clean energy sources, as management highlighted during the recent conference call:

The business is performing well and we are already seeing benefits of the investment beyond our underwriting as nuclear is increasingly recognized as a provider of clean dispatchable baseload power generation.

As an example, the Polish government announced that it has selected Westinghouse’s AP1000 technology for the build-out of the first three of its planned large scale nuclear reactors. This is the key step towards the country achieving its decarbonization targets and greater energy independence. We are also progressing our transition asset investments, including most recently, our investment in California Bioenergy, a leading California based developer, operator and owner of RNG assets, where we have the ability to invest up to £500 million or £100 million net to Brookfield Renewable in downside protected convertible structures that support the development of new agriculture renewable natural gas assets.

This spells opportunity for investors, as management targets 12% to 15% long-term annual total returns, and 5% to 9% annual dividend growth.

This includes the recent 5.5% dividend increase. This represents Brookfield Renewable’s 12th consecutive year of at least 5% dividend increases, and the dividend coverage ratio currently sits at a healthy 116%.

Meanwhile, BEPC maintains a very strong BBB+ rated balance sheet, with £1.1 billion in cash on hand plus receivables, and a safe net debt to TTM EBITDA of 5.3x. It’s also reasonably priced at £33 with a forward P/FFO of 18.6.

This is considering the 12% to 13% annual FFO per share growth that analysts expect this and next year, the strong balance sheet, and management track record.

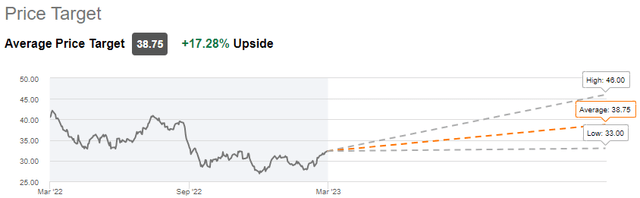

Analysts have a consensus Buy rating with an average price target of £38.75, which combined with the dividend translates to a potential 21% total return over the next 12 months.

Seeking Alpha

Investor Takeaway

In summary, Brookfield Renewable operates in the attractive renewable energy space, and could deliver double-digit annual returns over the next few years. BEPC has a strong presence in multiple geographies and a diverse portfolio of renewable assets. It also maintains a strong balance sheet with healthy dividend coverage ratios.

Lastly, BEPC stock is reasonably attractive at present for a meaningful starting yield and potentially market-beating returns going forward.