Ellington Financial: The 16.7% Yield Paid Monthly Is Risky (NYSE:EFC)

halbergman/iStock via Getty Images

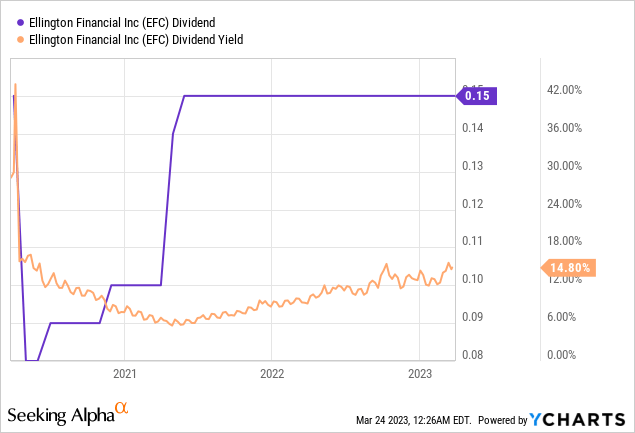

Ellington Financial (NYSE:EFC) last declared a monthly cash dividend of £0.15 per share, in line with its prior payout and for a 16.17% yield. Such a fat monthly yield has become more common in recent weeks across the mREIT space as the fallout of the Silicon Valley Bank receivership reverberates across the US fixed-income market. Ellington is a hybrid mortgage REIT with a total long credit portfolio of £2.54 billion as of the end of its last reported fiscal 2022 fourth quarter.

Data by YCharts

Data by YCharts

Long credit is formed from several assets including non-agency residential MBS, commercial mortgage loans, consumer loans and asset-backed securities.

The mREIT also owns agency residential MBS and Longbridge which owns unsecuritized HECM loans.

Book Value And Dividend Coverage

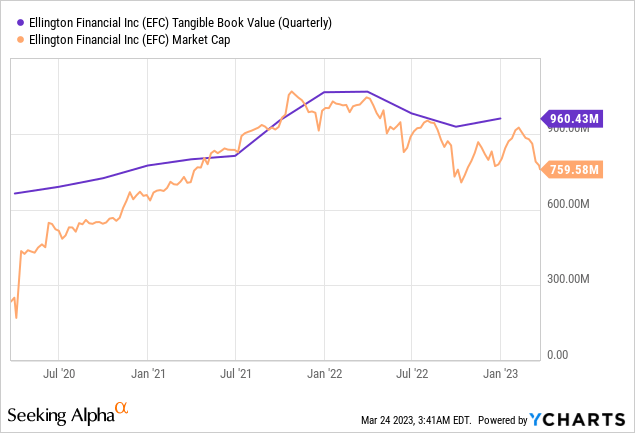

Book value for Ellington’s last reported quarter stood at £968.5 million, around £15.18 per share and up sequentially by 4.4% from £927.9 million in the third quarter. The mREIT updated the market post-period end to state that its book value per share had dropped to £15 as of the end of January.

Data by YCharts

Data by YCharts

January end book value against the current price of the commons means Ellington is trading at a nearly 26% discount to its intrinsic value. This discount has been persistent throughout the last year and only briefly inverted in the second half of 2021.

The gap has been extended in recent weeks on the back of the mini-banking crisis to create the conditions for new longs to potentially buy in at an abnormal discount. The company thinks so and recently authorized the buyback of up to £50 million worth of stock to presumably take advantage of the weakness.

Fourth quarter net interest income was £30.17 million, down from £38.47 million in the year-ago quarter. This drove net income attributable to common stockholders to £22.7 million, or £0.37 per share.

Adjusted distributable earnings, which includes unrealized gains, was higher at £26.0 million, around £0.42 per share. The mREIT’s payout ratio as per net income attributable to common stockholders was 121%, falling to 98% against adjusted distributable earnings. Both metrics are not healthy and the recent fall in book value raises the specter of a dividend cut.

This is somewhat countered by cash and cash equivalents of £217.1 million as of the end of the fourth quarter.

Exploring An Alternative With The Series B Preferreds

Ellington’s 6.25% Series B Fixed-to-Floating Rate Cumulative Preferred Stock (NYSE:EFC.PB) offers a more stable alternative albeit with a materially lower yield. They pay out a £1.5626 coupon annually for an 8.4% yield on cost. This yield is distributed quarterly and is nearly half the yield available on the common shares.

While these would immediately be less attractive based on these two factors, they still come with several features that render them a good investment in these trying times.

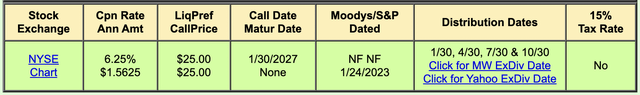

QuantumOnline

Firstly, they’re fixed-to-floating rate preferreds which will see the fixed coupon change to a floating rate at redemption equal to the sum of the five-year treasury rate plus 4.99%. This will happen on January 30, 2027, and reset every five years after. Whilst it’s hard to state what the treasury rate will be at redemption, it will fundamentally be driven by the inflation and Fed funds rate dynamic.

Hence, these will form a partial hedge against inflation with a floating headline rate that would be markedly higher than the current 6.25% were the preferreds to float in 2023.

Further, they’re cumulative and trading at a discount to their par value. The par value at £25 per share means the preferreds at £18.54 are trading at a 25.84% discount to par. This forms a critical avenue for returns with a yield to call of 15.09% comparing much more favourably to the yield on the commons.

As they’re cumulative, the likelihood of the current macroeconomic environment catalyzing a suspension of the payments is near-zero. Preferreds are essentially fixed-income securities and rank higher on the dividend totem pole than the commons. In this, economic disruptions like the early pandemic era margin calls that drove the marked dividend cut would have no bearing on the payouts to the preferreds owners.

The cumulative clause means any unpaid income accumulates as a liability on Ellington’s balance sheet to be repaid at a later date.

Seeking Alpha

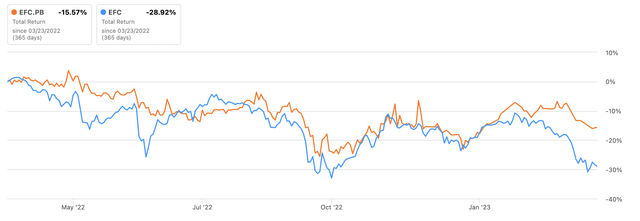

The Series B started trading in the final month of 2021 hence comparative returns against the commons only extend over the last year. With the marked rise in the Fed funds rate pushing down mREITs across the board, the preferreds are sporting a loss of 15.57% on a total return basis versus a loss of 28.92% for the common shares. This outperformance is likely to remain through 2023 as the Fed funds rate remains elevated and could be set for one more 25 basis point hike.

Overall, whilst I’m neutral on Ellington’s near-term prospect, the commons make a decent buy for more aggressive income investors.

The preferreds offer a healthy margin of safety with their discount to par and would fit within any portfolio orientated towards fixed-income securities.