Reliance is top Nifty 50 contributor as analysts bet on these four factors

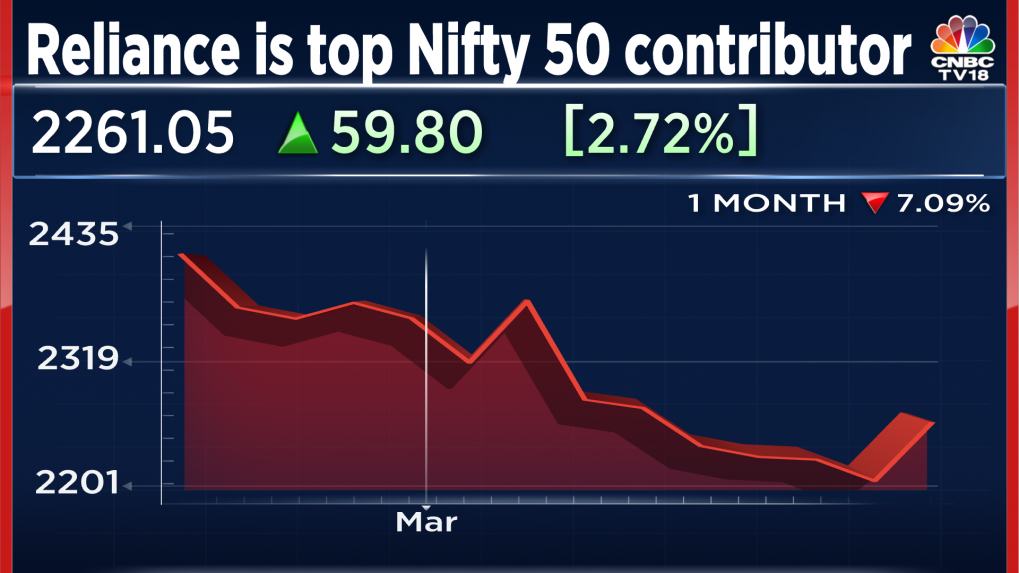

Reliance Industries shares were the top Nifty 50 contributor on March 21, after more than a week of falling and hitting a 19-month low yesterday.

Reliance Industries shares were the top Nifty 50 contributor on March 21, after more than a week of falling and hitting a 19-month low yesterday. This was RIL’s biggest losing streak in nine years. However, brokerages remain positive on the oil-to-retail-to-telecom conglomerate expecting a more than 30 percent upside in the stock.

Tuesday’s gain comes after the government marginally increased export duty on diesel to Rs one per litre from Rs 0.50 while keeping both petrol and Aviation Turbine Fuel (ATF) exempt from the export levy.

The new rate is set to be effective from Tuesday, March 21. Brokerage firm CLSA has called it a bargain buy, noting that Reliance’s stock has fallen by about 20 percent in less than four months, taking it to just five percent above a conservative valuation based on a nearly three-year old value deal for Jio and retail, a 15 percent discount to the announced Aramco deal value for O2C and nil value for new energy. It has a buy recommendation with a target price of Rs 2,970, implying a 35 percent upside from Monday’s closing price.

The brokerage believes the ramp up of Reliance’s FMCG business, launch of Airfiber to catapult wireless broadband penetration and a new affordable 5G smartphone to monetise its pan-India standalone 5G network by end 2023 along with IPO of Jio and/or retail are all possible large triggers in the second half of FY24. Jefferies reiterated its buy recommendation on Reliance Industries with a price target of Rs 3,100. The brokerage sees limited downside to RIL’s earnings and also little value being ascribed to the company’s new businesses (e-commerce, green energy, FMCG, financial services and new petrochemical investments) at its current market price.

It must also be noted that the gains in Reliance shares are on a day when the market is witnessing a relatively positive sentiment, tracking a rebound in global equities on temporary relief from the rescue of financial heavyweight Credit Suisse, although contagion fears in banking cast a shadow.