Ellington Financial's Newest Preferred Series Now Yields 10%

Melpomenem

We recently made note of the obscure, newer preferred issue from AGNC Investment Corp. (AGNC) and described that market volatility had knocked it down to a price for the attractive acquisition. It seems the same situation has evolved for the February 2023 issued Ellington Financial Series C Preferred (NYSE:EFC.PC) and that it too might now be priced right to be a high-performing addition to the fixed income side of a portfolio.

Trying Times for mREITs

All through March, we heard about the difficulty banks have had navigating our rapidly rising interest rate environment. Silicon Valley Bank collapsed in being unable to satisfy a run on the bank’s uninsured deposits that had been invested in declining bonds classified as held-to-maturity. mREITs are not banks but they do invest in debt instruments and many function as non-bank lenders.

Unlike the Regional Banks or Charles Schwab (SCHW), however, mREITs subject most of their assets to mark-to-market reporting. Market volatility has made life operationally more complex for mREITs, and they have each charted their own paths in managing their capitalization and balance sheets. Some have elected to reduce their borrowings; some, like AGNC and Ellington Financial (EFC) chose to boost capital through the issuance of common or preferred stock.

Our focus on mREITs has not been the opportunity that might lie in the high dividends of the common shares, but instead the appeal of favorably priced preferred shares as they might accretively contribute to the fixed income portion of our investment portfolios. As such, we want to understand the issuer’s business model and that it can support the common.

Ellington Financial

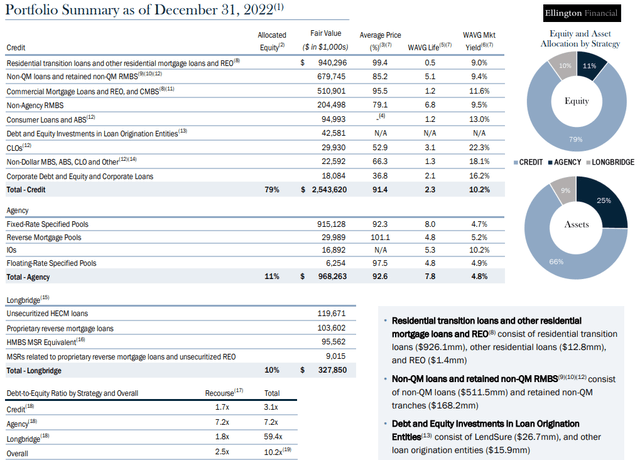

In a March 2023 presentation to its Debt and Preferred Equity Investors, Ellington Financial provided a weighted breakdown of its various business activities as of 12/31/2022. As the table shows, EFC primarily invests in credit lending, with some exposure to Agency issues, and a growing interest in reverse mortgage lending (Longbridge).

EFC

Every mREIT has had a changing portfolio mix depending on what they came to find more opportune or risky.

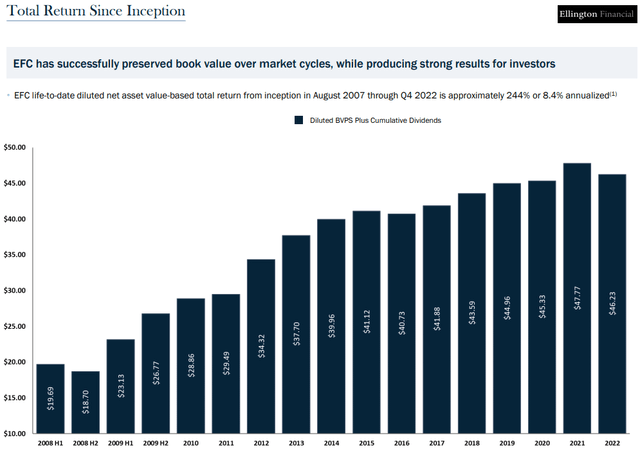

EFC is quick to point out that their operations, since inception, have provided a strong 8.4% annualized total return.

EFC

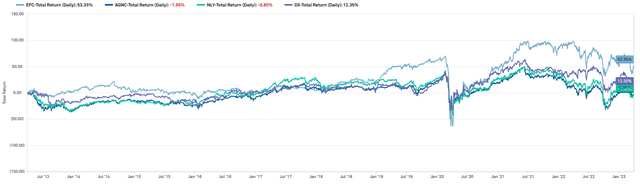

This appears to be a superior return to many of EFC’s peer sets, and that is also demonstrated in comparative common stock market performances.

S&P Global IQ

Ellington Financial has survived and prospered, and that satisfies a basic test for its ability to support the preferred shares. We can now get to the process of measuring the relative utility of investment in the newly issued EFC.PC.

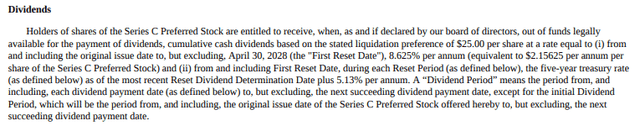

The Equity Capital Stack

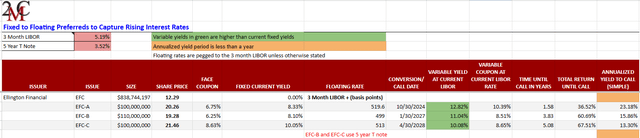

Portfolio Income Solutions, 04/03/2023

Each of the three EFC preferred series has fixed to floating coupons and while the preferreds A and B trade at steeper discounts to par, the preferred C’s whopping 8.625% face coupon has superior appeal today. At £21.50/share, EFC.PC delivers a carrying yield of 10% until it converts or is called on April 30, 2028.

At conversion, the coupon adjusts to 5-year Treasury rates +513 basis points.

EFC

With earlier conversion dates, EFC.PA and EFC.PB will get a bigger dividend boost if interest rates remain elevated, but predicting where rates will be in eighteen to forty-five months from now is an educated guess, at best. EFC.PC’s 8.625% coupon is fixed for the next five years and delivers the 10% yield with a higher degree of certainty. As the April 2028 conversion date approaches, the market can get a better idea of what the future brings and adjust according.

Dislocation is Temporary

Ellington Financial announced the EFC.PC pricing on February 3, 2023.

Piper Sandler & Co. acted as the sole book-running manager for the offering. In subsequent weeks, when closures of Signature Bank and Silicon Valley roiled markets, the owners of the new preferred issue might have experienced buyer’s remorse. If they elected to sell the EFC.PC shares, they faced a dearth of bids because buyers of anything but treasuries had stepped to the sidelines.

If the Fed is soon done with hiking interest rates and markets calm, EFC.PC will begin to drift closer to yield parity with the other EFC preferreds.

Until then, you might want to check out the 10% yield.