Intel Stock: A Bargain For Long-Term Investors (NASDAQ:INTC)

4kodiak

We maintain our buy rating on Intel (NASDAQ:INTC). We see a significant upside ahead for the stock as INTC plans to execute its process node roadmap migration and establish itself as a meaningful foundry player towards 2025. We believe INTC is on the verge of a turnaround and provides an attractive valuation.

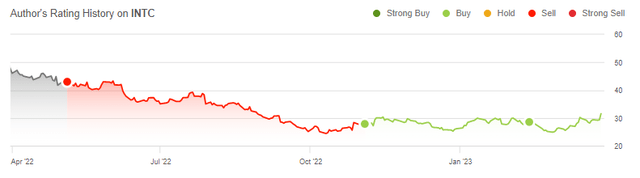

The stock is already up nearly 15% since we upgraded back in November, outperforming the S&P 500 by 7% during the same period. Still, we expect the stock to rally further towards the end of the year as we believe many more positives have yet to be priced into the stock. The following graph outlines our rating history on INTC stock.

Seeking Alpha

We believe the weaker PC Client demand and share loss to Advanced Micro Devices (AMD) that dragged the stock down in the post-pandemic environment will be less of an issue for INTC going forward.

PC Client TAM is still expected to shrink this year; forecasted to drop 14-18% Y/Y from 292M in 2022 to 240-250M in 2023. We see the PC TAM contracting around 10% to 260M. The positive note, however, is that we expect INTC’s share loss to AMD in the PC market has come to an end.

We also expect INTC’s new product roadmap will help further stamp share loss to AMD in the data center market. The stock price remains volatile in the near term due to the broader macro environment. Still, we believe INTC provides a favorable risk-reward scenario and recommend long-term investors begin looking for entry points at current levels.

FY2023 & what’s next

INTC stock declined 34% over the past five years, down 44% in 2022 alone – we were sell-rated on the stock in May 2022 and upgraded in November after the stock shredded roughly 39%.

Since our upgrade, the stock is up nearly 17%, and we see a long-term stock rally materializing as INTC’s financial performance improves and its data center TAM expands.

Our previous note on INTC presented a bullish sentiment driven by our belief that PC Client market share loss to AMD would moderate meaningfully and INTC’s “Sapphire Rapid” server CPU would aid in further stamping share loss. Now, we reiterate our bullish sentiment and add new positive notes from the company’s Data Center and Artificial Intelligence (DCAI) Business Update webinar. This week’s investor update on its server CPU roadmap execution does give us confidence that the company will be able to moderate its share loss in its server business to AMD by 2024.

Our key takeaway from the DCAI investor update is that a lot is happening in the server CPU business.

Despite delays, INTC is finally shipping their “Sapphire Rapid” server CPUs in high volume as part of the 4th generation Xeon Scalable lineup. INTC is not maneuvering an easy macro backdrop; cloud spending continues to soften due to the rough macro environment – we expect the weaker spending environment to take a toll on AMD, INTC, and Nvidia (NVDA) as the data center CapEx for cloud service providers shrinks in 2023 compared to 2022. While we expect the macro headwinds to cause near-term pain for INTC, we believe INTC’s investor update confirms that the company is playing the long game.

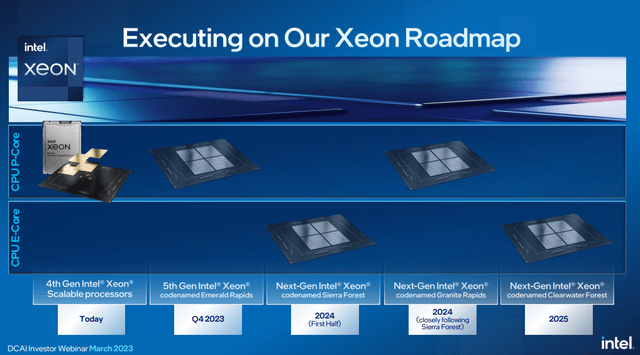

We expect INTC to experience demand tailwinds from its “Sapphire Rapid” server CPUs and see sales boosting further through 2024 driven by INTC’s “Sierra Forest,” the first Efficient-core (E-core) Xeon processor, on track for 1H24.

The following image outlines the INTC roadmap plan.

INTC DCAI investor update 2023

INTC reported revenue of £14B in 4Q22, down 32% Y/Y on a GAAP basis and 28% Non-GAAP basis. The company’s gross margin also shrunk last quarter from 53.6% in 4Q21 to 39.2% in 4Q22. At face value, these numbers don’t inspire much confidence, but we see INTC regaining revenue growth as it plans to execute a roadmap that encompasses five new process nodes in four years- bringing back its leadership position in the data center market.

We also expect the current explosion of AI potential in the public eye will bring the next leg of growth for INTC’s CPUs as the company predicts AI workloads will continue to be run primarily by CPUs. We believe INTC’s Xeon 4th generation “Sapphire Rapid ” CPU and its AI-optimized Habana Gaudi2 GPU to compete with NVDA to provide alternative platforms for AI/Machine Learning (ML) training. An open-source ML organization, Hugging Face, showed reports exemplifying that INTC’s hardware successfully delivered performance gains for training and running ML models.

We expect the new data center roadmap to enable the company to go head-to-head with AMD and NVDA more meaningfully. INTC currently forecasts its data center TAM to be valued at £110B, growing at a low 20s CAGR between 2022 and 2027. We recommend investors buy into INTC’s growth prospects in the long run.

Valuation

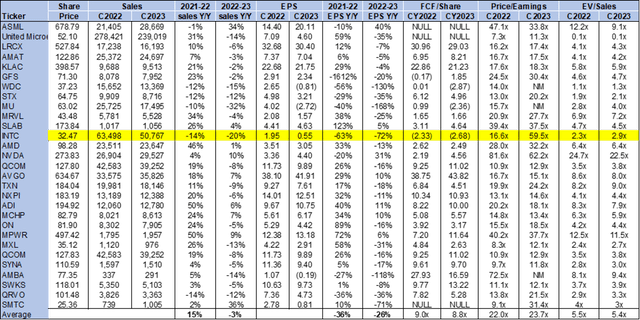

INTC is relatively expensive on a P/E basis, trading at 59.5x C2023 EPS £0.55 compared to the peer group average of 23.7x.

The stock is trading below the peer group on an EV/Sales metric, trading at 2.9x C2023 versus the peer group average of 5.4x.

The following table outlines INTC’s valuation relative to the peer group.

TechStockPros

Word on Wall Street

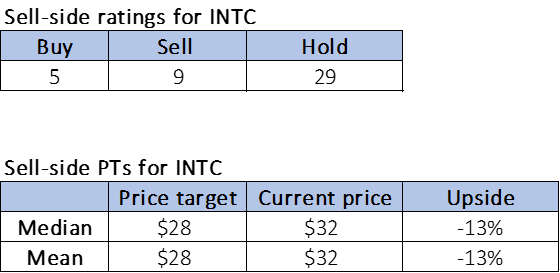

Wall Street is bearish on the stock. Of the 43 analysts covering the stock, five are buy-rated, 29 are hold-rated, and the remaining are sell rated. We believe Wall Street analysts’ bearish sentiment is driven by potential near-term downside for INTC due to macro headwinds causing a weaker spending environment.

We also expect the market is skeptical about whether INTC can achieve its roadmap toward 2025 and meaningfully recover from the lows of the post-pandemic environment.

The following table outlines INTC’s valuation.

TechStockPros

Word on Wall Street

In spite of market pessimism, we continue to be buy-rated on INTC stock. We believe if INTC can execute its stated process node roadmap migration, it can become a strong, credible foundry in the advanced node. We also expect INTC will be less pressured by share loss to AMD going forward as it regains its competitive edge.

Still, we see some near-term pain due to softer cloud spending and as the PC Client market continues to contract.

We believe investors willing to wait out the short-term pain and look for entry points at current levels will be well-rewarded toward 2025.