Kimco Realty Stock: Buy Premium Assets At A Bargain Price (NYSE …

z1b

It hasn’t been that long since I last visited Kimco Realty (NYSE:KIM) in mid-January here, but it feels much longer, considering all that’s happened in economic news since then. In this article, I revisit the stock, highlight recent developments, and give an updated valuation and recommendation, so let’s get started.

Why KIM?

Kimco is one of the largest shopping center REITs in the U.S., alongside peer Regency Centers (REG). Unbeknownst to some, KIM is actually bigger than Federal Realty Investment Trust (FRT), one of the oldest REITs on the market today.

KIM’s properties are centered around high-barrier to entry Coastal markets as well as fast-growing Sunbelt markets and at present owns 532 properties comprising 91 million square feet of gross leasable area.

Those familiar with the company may know that KIM has vastly transformed itself over the past decade, in response to changing consumer tastes.

This includes disposing of lower quality properties in secondary markets and recycling the capital into higher quality properties in growth markets. In total, 84% of KIM’s annual base rent now comes from Coastal and Sunbelt markets.

This transformation is reflected by the fact that 81% of KIM’s annual base rent now comes from grocery-anchored properties, which are more e-commerce resistant. Longer-term, management targets an even higher 85% of ABR coming from grocery-anchored centers.

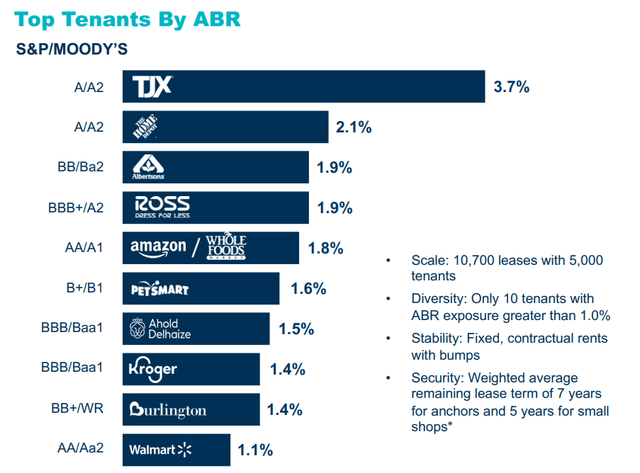

As shown below, KIM’s top tenants include household names with very strong credit ratings, including TJX Companies (TJX), The Home Depot (HD), Ross Stores (ROST), Whole Foods (AMZN), Kroger (KR), and Walmart (WMT).

Investor Presentation

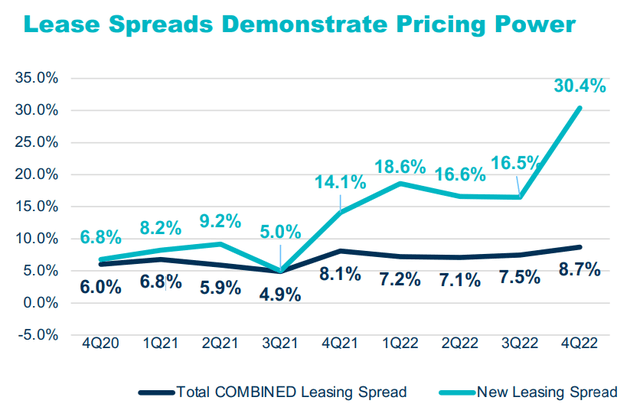

Meanwhile, KIM enjoys a high 96% occupancy rate, and is seeing strong demand from tenants, with 30% rent spread on new leases executed during the fourth quarter, contributing to 4.4% same-store NOI growth. KIM’s lease spreads have grown every quarter since late 2020 (30% spread in Q4 2022) and has picked up steam over the past 18 months. Looking forward, KIM stands to benefit from strategic portfolio positioning, as it seeks to add value to its last mile properties with mixed use, including apartment units.

Investor Presentation

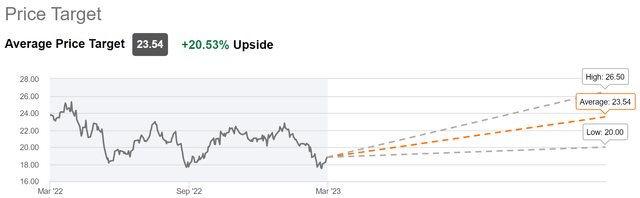

Meanwhile, it seems that the recent collapse of SVB Financial Group along with concerns around regional banks such as First Republic Bank (FRC) has spooked REIT investors, including those of KIM, as the stock is now trading toward the low end of its 52-week range, as shown below.

KIM Stock (Seeking Alpha)

It seems, however, that the concerns are overblown, as KIM is obviously a non-bank with physical assets, and shouldn’t have problems tapping debt markets, as capital simply flowed from regional banks into the hands of large players like Bank of America (BAC) and JPMorgan Chase (JPM).

Moreover, there are signs that inflation is easing, as the February CPI report showed a sequential 0.3% rise in benchmark prices, which was lower than what many economists had expected.

Plus, the Fed responded to the recent implosion of a few banks with just a quarter point rate increase in the last meeting.

This all bodes well for REITs who stand to benefit from high tenant demand, as cost of debt looks to stabilize. Meanwhile, Kimco maintains a strong BBB+ rated balance sheet, which should help it to secure relatively low cost of debt funding. Over 99% of its debt is fixed rate and has a long weighted average remaining term of 9.5 years.

KIM also has £2.1 billion worth of liquidity and retains significant value in its Albertsons (ACI) stake, with 28 million shares valued at £600 million.

This all lends support to KIM’s 4.7% yield, which is well protected by a 59% payout ratio (based on Q4 FFO/share of £0.39). Considering all the above, KIM appears to be trading in value territory at the current price of £19.53 with a forward P/FFO of just 12.4. Analysts have a consensus Buy rating with a conservative price target of 23.54, which equates to a potential 25% total return over the next 12 months.

Seeking Alpha

More conservative income investors seeking a higher yield may want to consider the Preferred Series M shares (NYSE:KIM.PM), which currently trades at £20.30, equating to a 19% discount to liquidation value.

KIM.PM currently offers a 6.5% yield, and the dividend is cumulative, which means that preferred investors will be paid any missed dividends before common shareholders are paid, should dividends be suspended.

Lastly, while KIM.PM is trading past its call date of 12/20/22, it’s unlikely that KIM will call back the shares in the current high interest rate environment, and even if the shares do get called back at £25, preferred investors will get an immediate capital appreciation from the current price.

Investor Takeaway

Kimco Realty is an attractive income play in the real estate sector with a 4.7% dividend yield and a BBB+ rated balance sheet.

It enjoys a high occupancy rate, strong rent spreads, and a conservative payout ratio.

KIM stock appears to be trading in value territory at the current price, setting up income investors for potentially highly rewarding returns.

Conservative income investors may want to pick the preferred shares, which come with a higher yield and a significant discount to liquidation value.