PaySign: Growing Microcap With 40% Market Share (NASDAQ:PAYS)

Andrii Zastrozhnov/iStock via Getty Images

PaySign, Inc. (NASDAQ:PAYS) is a growing microcap stock generating 90% of its revenue offering payment solutions for plasma donation centres. Since entering the market in 2011, PAYS has seen impressive market share growth, now servicing 40% of all plasma collection centres in the USA. The stock price has recently benefited from the company posting its Q4 and FY 2022 report, announcing a £5 million stock repurchase program and forecasting a higher-than-expected EPS guidance for FY2023.

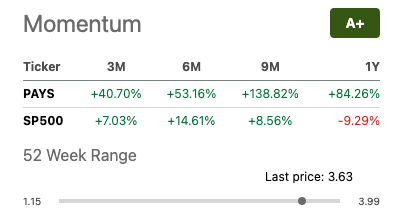

Since my previous article in January, the stock has increased by 10.33%. Over the last year, investors have been rewarded with 84.26% in returns.

One-year stock trend (SeekingAlpha.com)

COVID-19 headwinds heavily impacted the business, but it is slowly recovering, reporting a positive net income of £1 million for FY2022. PAYS has a healthy balance sheet, positive free cash flow, new plasma centre growth is expected to continue for 2023, its patient affordability programs for pharmaceuticals are gaining momentum, and we see the company diversify its portfolio into new verticals including payroll, retail and gifting.

Furthermore, Canada is considering compensating for plasma donations, which could open up significant growth opportunities for PAYS. Therefore I remain bullish on this stock.

Company highlights

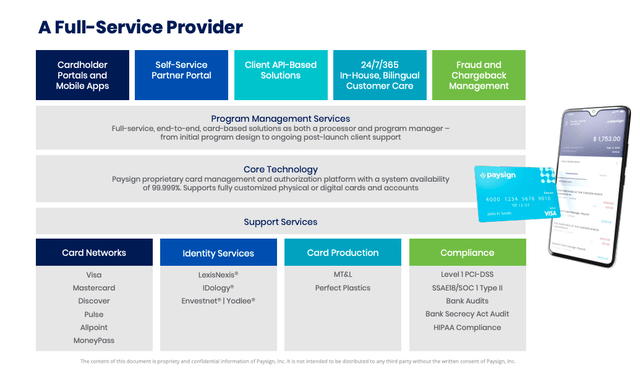

In my previous article, I give an overview of the business. PAYS offers prepaid card products and processing services, as seen in the image below, for various customers and revenue is broken down into the plasma and pharma industries.

Plasma is the most significant part of the business, making up about 90% of the total revenue. PAYS is diversifying its portfolio, recently launching a gift card business.

Payment solutions and services (Investor presentation 2022)

FY 2022 was a year of impressive growth numbers. Cardholders increased by 29% to reach 5.3 million via 550 card programs.

PAYS increased its plasma donation centres by a net of 78 locations, giving a total of 444 centres at the end of 2022. Sales cycles have shortened from 7 to 9 months to an average of 90 to 120 days, and many of their clients have plans to grow their number of centres. PAYS forecasts 45 to 55 centres opening in 2023.

However, one of their clients will be closing down 16 of its centres so we can expect growth between 29 to 39 new centres. Although the pharma industry revenue declined YoY by 0.6%, PAYS is increasing its revenue potential through patient affordability programs in three top 20 pharmaceuticals. PAYS more than doubled its active programs YoY to 19 programs in 2022.

Seven programs have already been launched in 2023, and 19 additional programs will go live in the next six months. Lastly, if Canada is to start compensating for the plasma donation, the business could enter a significant new market.

Financials and valuation

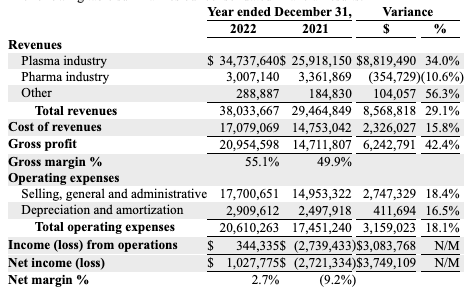

PAYS saw an improvement in its top and bottom line results year on year and ended Q4 2022 on a solid note. We can see that total revenue for FY2022 increased by 29.1%, largely driven by growth in its plasma industry.

Operating expenses increased YoY by 18.4%, largely related to labour, insurance and travel costs connected to growing the business.

Financial overview (sec.gov)

For Q4 2022, revenue was £10.6 million, an increase of £1.9 million or 21% YoY. reported a net income of £713,000. PAYS is in a better cash position than one year ago due to increased customer programs and higher funds on the cards. It has a levered positive free cash flow of £1.18 million.

It raised its unrestricted cash balance by 31% YoY to £9.7 million, with a current ratio of 2.1, and it increased its restricted cash balance by 31% to £80.2 million. The company has zero debt and announced a £5 million share repurchase program over 26 months. For 2023, total revenues are expected to be £44 million to £46 million, an increase of 16% to 21%, with plasma making up approximately 90% of total revenue.

PAYS has a one-year average target price of £4.81, which is below the current stock price and is rated as a Buy on Marketscreener. After the Q4 Earnings release and the positive 2023 guidance, various analysts have increased the price target, with Barrington increasing the target price to £5.5 from £4.00.

If we compare the stock trend to the S&P 500 index, we can see that it has outperformed this last year, related to its strong recovery and positive growth outlook.

PAYS versus S&P 500 (SeekingAlpha.com)

Final thoughts

The company reported annual revenue growth of 29% to reach £38.0 million. Adjusted EBITDA increased by 175% YoY to £5.5 million. It has a healthy balance sheet and is forecasted to onboard many new centres.

It is expanding its offering into payroll, retail and gifting while building its affordability programs for pharmaceuticals.

Furthermore, there is long-term growth potential in Canada’s potential new paid plasma market.

Therefore I remain bullish on this stock.