These Are 3 of the Best Growth Stocks to Buy in April

Want to maximize your potential gains from the current bear market? Consider loading up on growth stocks. These are businesses in sectors that stand to generate strong cash flows, which in turn can lead to sustainable, oversize gains for long-term investors.

Right now, three of the best growth stocks for investors to consider include Microsoft (MSFT -0.02%), PayPal (PYPL -0.04%), and CVS Health (CVS 0.21%). Let’s see why.

1. Microsoft

Microsoft may be a huge company, but it is sill an exciting growth stock to own because its business is so broad and full of opportunities.

Expanding further into video games and acquiring Activision Blizzard, should the deal go through, will give it a significant runway. For years, the company’s Bing search engine has been the soft spot, usually ranking far behind Alphabet‘s much more popular Google search. But with Microsoft spending billions on artificial intelligence (AI) and working with ChatGPT, there’s potential for Bing to close the gap on Google.

And if it does, that could mean more ad revenue and yet another source of attractive growth for the company. As the ChatGPT hype grows, so could the bullishness behind Microsoft’s stock. It trades at 31 times earnings, and that premium could go still higher as investors start to adjust what they’re willing to pay.

Between the possible Activision acquisition and a new AI-powered Bing, the company’s growth could become more impressive in the years ahead. Even at a £2 trillion valuation, the stock still looks like a solid buy right now.

2. PayPal

Fintech stocks, including PayPal, haven’t been performing well of late as investors brace for a slowdown in the economy this year and a possible recession.

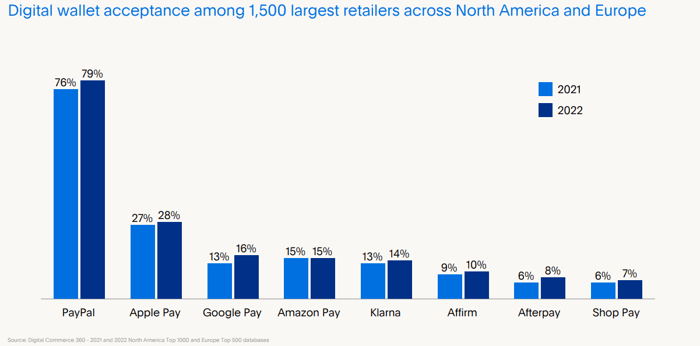

But with the stock off sharply — and not far from its 52-week low of about £66 — it could be a bargain buy. While there are other services that merchants accept for payment online and there is no shortage of competition, it’s clear that PayPal is still the default choice:

Image source: PayPal Q4 2022 investor update. Last year, the company’s net revenue totaled £27.5 billion and rose 8% from the previous year.

That growth rate could deteriorate if there’s a slowdown in consumer spending this year, but it’s not a long-term trend that should worry investors. The popularity of PayPal and strong acceptance of its service is what should encourage investors to buy the stock while its valuation is low. As the economy recovers, so too should the value of this promising growth stock.

3.

CVS Health

Another stock that investors should be careful not to overlook right now is CVS Health. It’s also trading near its 52-week low of about £72 as investors may be bearish on all the acquisitions it has been pursuing of late. But those are moves that can pay off in the long run.

CVS is already a healthcare giant with a pharmacy benefits business, a health insurance business, and its retail pharmacy business. Its recent acquisitions of home-health company Signify Health and primary care provider Oak Street Health (still pending) could further diversify its operations and make CVS the ultimate healthcare investment by giving investors a broad array of segments under one umbrella. The company has already demonstrated strong growth over the years with revenue of £256.8 billion in 2019 rising to £322.5 billion this past year.

And with more opportunities in the future, CVS could make for an underrated growth stock to buy right now, especially now that it’s down close to 30% from its high. Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. David Jagielski has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Activision Blizzard, Alphabet, Microsoft, and PayPal.

The Motley Fool recommends CVS Health.

The Motley Fool has a disclosure policy.